Take look at our

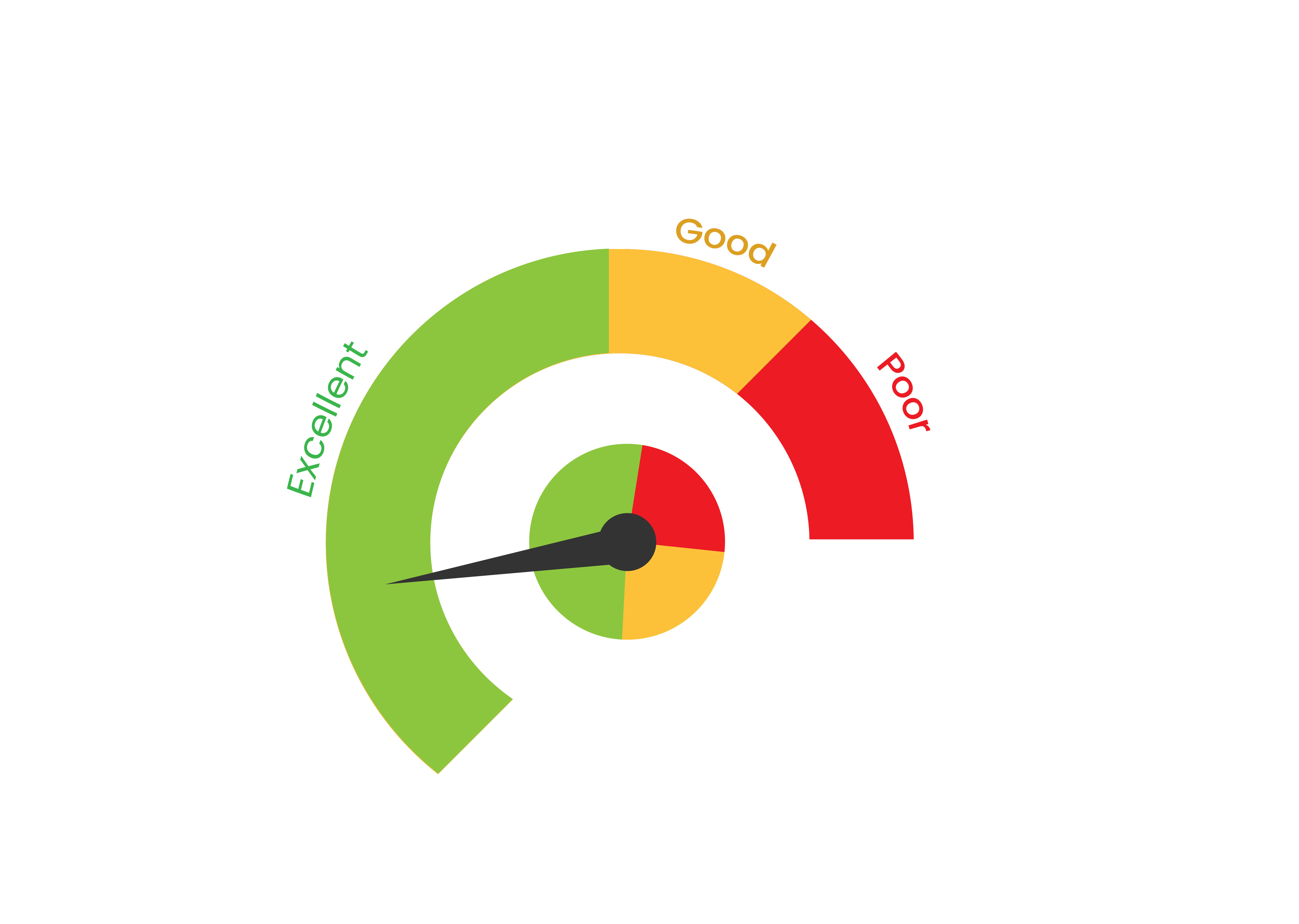

The Chit score is determined by the borrower's previous chit / loans and financial situation.

The Chit Score is a comprehensive evaluation tool developed by Smart Global Solution to assess the creditworthiness and risk associated with chit fund organizations and financial company. This score aims to assist financial institutions in making informed decisions when considering lending to or engaging in financial transactions with chit funds. By analyzing various factors and parameters, the Chit Score provides a reliable assessment of the financial health and stability of chit fund entities. Chit score facilitates the chit status of a new person who joins your company and alerts other companies whose members joined with a chit score about the NPA's list and their guarantee list in your company. chit score helps to protect financial position as well as reduce non- receivable accounts

Discover

Benefits of Membership Risk management solutions from CHIT SCORE offer a variety of advantages, including:

Eligibility

CHIT SCORE Membership is available to the following institutions: